Solution

Downside Equity Risk

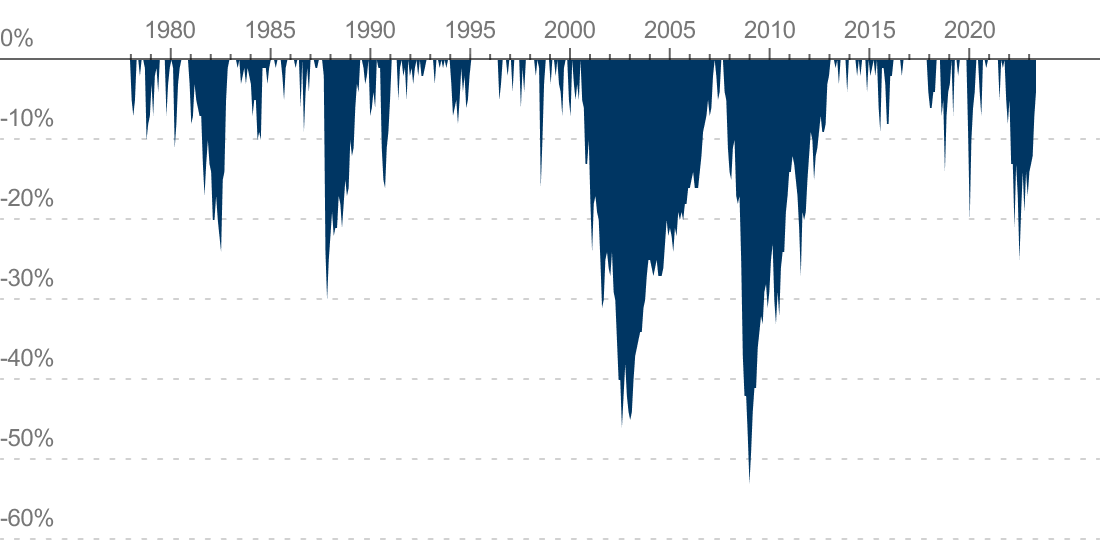

Equity portfolios are vulnerable to tail risk – when equity markets fall, they can fall quickly and dramatically. Investors with significant equity holdings and looming liabilities may be concerned about this downside risk.

S&P 500 Historical Drawdowns

January 1978 – July 2023 Source: Wall Street Journal

Tail Risk Strategy

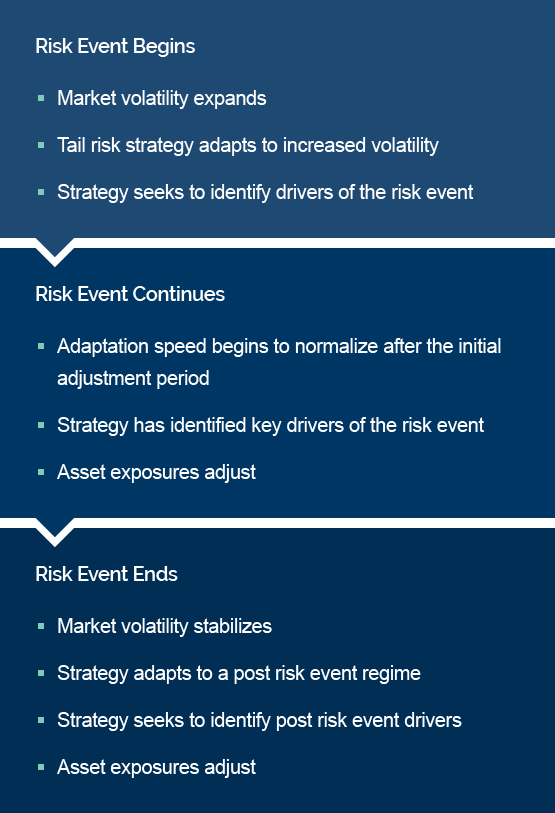

A tail risk strategy can address this risk. Key characteristics of a successful tail risk strategy include strong performance during periods of equity market dislocation, the ability to adapt to varying risk environments, low correlation to equities, and daily liquidity. P/E’s adaptive process allows for flexibility during risk events as our strategies work to identify the leading drivers of changing market environments.

Our strategies for qualified eligible investors have historically performed well during periods of equity market dislocation.*

Interested in learning more?

Contact Us *PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THIS MANAGER OPERATES PURSUANT TO AN EXEMPTION FROM THE COMMODITY FUTURES TRADING COMMISSION IN CONNECTION WITH ACCOUNTS OF QUALIFIED ELIGIBLE PERSONS, THIS BROCHURE OR ACCOUNT DOCUMENT IS NOT REQUIRED TO BE, AND HAS NOT BEEN, FILED WITH THE COMMISSION. THE COMMODITY FUTURES TRADING COMMISSION DOES NOT PASS UPON THE MERITS OF PARTICIPATING IN A TRADING PROGRAM OR UPON THE ADEQUACY OR ACCURACY OF COMMODITY TRADING ADVISOR DISCLOSURE. CONSEQUENTLY, THE COMMODITY FUTURES TRADING COMMISSION HAS NOT REVIEWED OR APPROVED THIS TRADING PROGRAM OR THIS BROCHURE OR ACCOUNT DOCUMENT.