Solution

Highly Correlated Assets

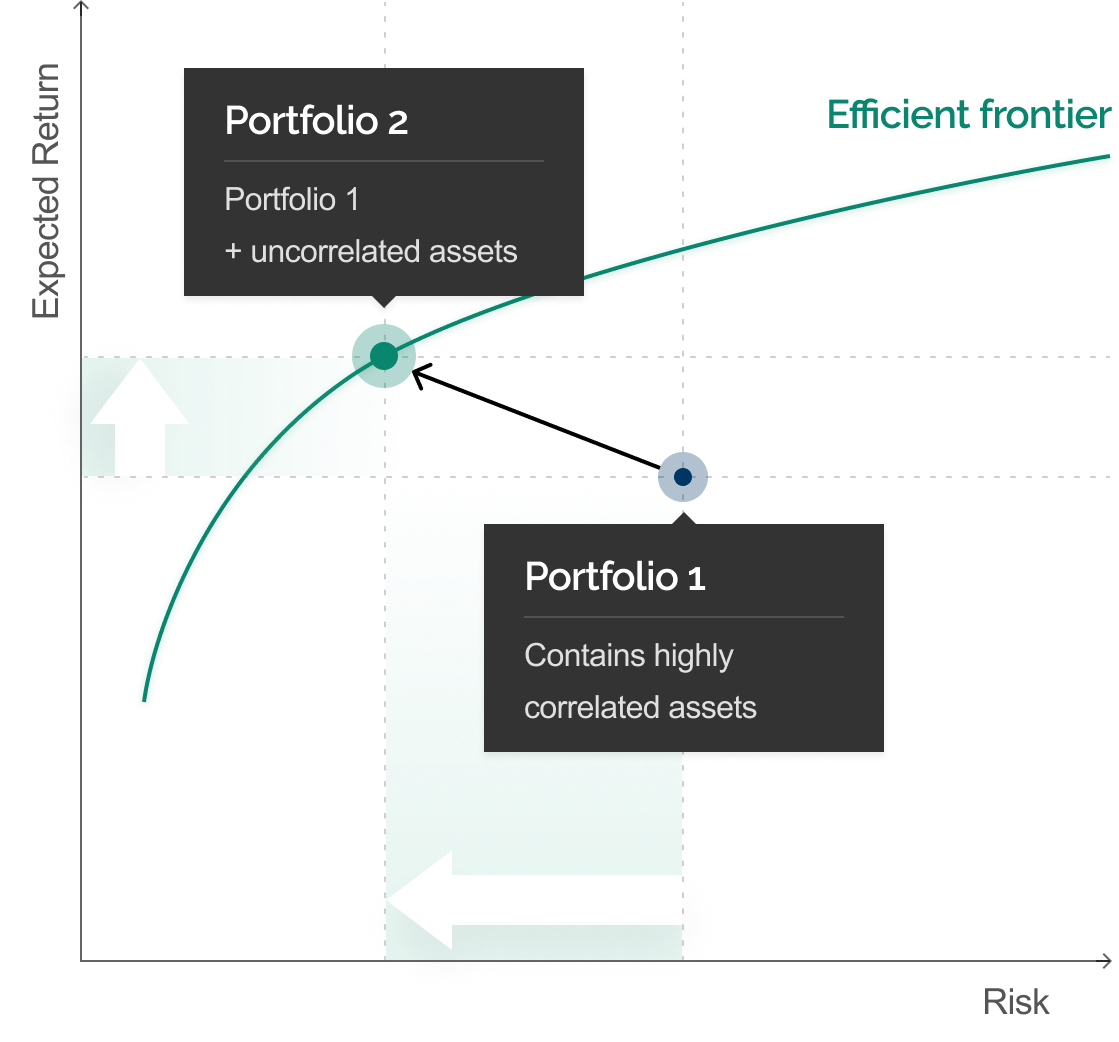

It is common for a traditional portfolio to contain several highly correlated assets. This correlation comes with significant risk, as when one asset falls, it’s likely that the rest of the portfolio will fall as well.

Uncorrelated Alpha

By investing in uncorrelated alpha, a portfolio manager can mitigate this diversification risk.

Diversification Benefit

Our strategies for qualified eligible investors have historically exhibited low to negative correlation to many traditional investments.*

Interested in learning more?

Contact Us *PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THIS MANAGER OPERATES PURSUANT TO AN EXEMPTION FROM THE COMMODITY FUTURES TRADING COMMISSION IN CONNECTION WITH ACCOUNTS OF QUALIFIED ELIGIBLE PERSONS, THIS BROCHURE OR ACCOUNT DOCUMENT IS NOT REQUIRED TO BE, AND HAS NOT BEEN, FILED WITH THE COMMISSION. THE COMMODITY FUTURES TRADING COMMISSION DOES NOT PASS UPON THE MERITS OF PARTICIPATING IN A TRADING PROGRAM OR UPON THE ADEQUACY OR ACCURACY OF COMMODITY TRADING ADVISOR DISCLOSURE. CONSEQUENTLY, THE COMMODITY FUTURES TRADING COMMISSION HAS NOT REVIEWED OR APPROVED THIS TRADING PROGRAM OR THIS BROCHURE OR ACCOUNT DOCUMENT.